Before starting this blog we need to understand a few things that we have read in my previous blog “What is the difference between Financial Security and Investments”.

We understood well that what is the difference between financial security and investments.

Let’s re-memorize two main things which we have learnt….

- Only secured investment schemes can create real financial security.

- The money or monthly income required to sustain your basic needs is your financial Security.

Most people presume that whatever investments they are doing, all are their financial security but the fact is only your secured investments can create real financial security which keeps your mind cool/ stable and helps to live life financially stress-free.

What factors should be considered while building Financial Security?

You should consider three factors while creating your financial security.

- Money for sustainability should be accessible at any time in case of emergency.

- Your principal amount & returns should be secured.

- It should give reasonable returns that should at least beat inflation.

What kind of fund/ income you should create?

Two kinds of income you should create. First, you should create a corpus fund in such a way that you can able to take out after age 45, if late then not more than your age 58. Second, you should create monthly income in such a way that you should start getting every month when you reach age 45. If you are late too then it should start getting at maximum at your age 58.

Two main sources of income you should create…..

- You should get a monthly income per month for a longer period around 25 years which you should start getting at age between 45 to 58 and should continue till 25 years.

- You should get a Lump-sum maturity amount age between 45 to 58.

If you can able to create these two things that can help you to take care of your basic needs then you are Financially Secured.

Let’s understand in detail two main things…

- Lump-sum corpus.

- Monthly regular income.

1. Lump-sum corpus –

After age 45, you need a lump-sum amount or fund in your hand which will be like your backup money. This back-up money should be for emergency needs and should be touched in case of very high emergencies. This or part of this must be accessible at any time.

This fund should be invested in a secured investment scheme and the returns should at least beat inflation.

2. Monthly Regular Income –

You need regular income per month which should start after age 45 and continuously remain for a minimum of 25 years till your age 70. This investment should be done in such a way that every month between the 1st to 5th day of the month you get this amount every month like a salary.

It should be invested in well-secured schemes where your money is secured and should give reasonable returns that at least beat inflation. This money should be accessible between the 1st to 5th day of the month every month.

Let’s take the example of Mr. Mohan

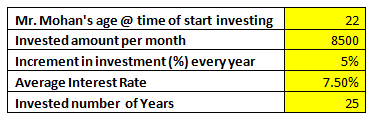

To better understand, let’s take the example of Mr. Mohan who presently is of age 47. He started his job at the age of 22 and started investing for financial security since then.

He has been investing some amount for both lump-sum corpus and for monthly income. The rest of the savings he is investing in medium-risk schemes, risk investment schemes and assets.

To create a lump-sum corpus, he has been investing Rs 12,500/- every month between date 1st to 5th of the month from age 22 till age 46 in Public Provident Fund (PPF) which is a lock-in scheme by Govt. of India and completely secured. He got average returns of 7.5% per annum. After completion of 25 years he has received a maturity amount of around Rs 1,07,00,000/- ( Rs 1.07 Crore).

To create monthly income, he has started investing Rs 8,500/- every month since age 22 between date 1st to 5th of the month in the secured post office investment schemes which is of Govt. of India and completely secured. He got an average return of 7.5% per annum. Also, he has been increasing the monthly investment amount by 5% every year since the beginning. This he has done from age 22 till age 46. Now his age is 47 and started getting a monthly income of Rs 50,836/- per month for first year and every year he will get 5% more monthly income. This monthly income he will get till the age of 71. In the 71st year, he will get a monthly amount of Rs 1,67,176/- for entire year.

Let’s see his investment amount in detail in the below chart…..

See the chart above. Now his age is 47 and the investment of Rs 8,500/- every month which he made in 1st year at age 22, now he is going to get a maturity amount of Rs 51,836/- every month till one year at age 47. Further every year he will get 5% extra monthly as he has invested 5% extra every year. When he will be of age 71, he will get a monthly income of Rs 1,67,176/- which he will get whole year.

So how Mr. Mohan is financially secure?

Here Mr. Mohan received an amount of Rs 1.07 Crore in age 47 and this amount he has invested in secured bank schemes on average interest of 7% per annum compounded from where he is getting around Rs 65,000/- per month interest income. The principal amount is always available with him which he is not touching.

Apart from this interest income he is getting a monthly income of Rs 51,836 which will increase 5% every year and will reach Rs 1,67,176/- per month when he reaches age 71. So his total monthly starting income at age 47 is Rs 1,16,836/- which will be further increased as per the below chart.

The income is completely effortless. With this income now he has become financially free and very easily manages the basic needs of the family. Also other than this, he has been investing amounts in different investment schemes which also created assets like houses and additional funds which are going to give continuous returns.

He started his job at 22 year age and now at age 47 he has completed 25 years of service and become financially free. Now he is using his professional experience and guide people & help society which is giving fulfillment in life and same time by which he is earning by default.

What is the right age to start investing?

If you start investing early you can able to achieve financial security at an early age. Here I have considered investment tenure of 25 years for which the minimum age can be 18 and the maximum age can be 33. If your age is above 33 then you can reduce the investment tenure in such a way so that you can able to create a financial security maximum of your age of 58.

So this way you can also create your financial security.

Focus on your Financial Security and continuously working on that will give you freedom in life at the age around 45 or before too if you focus on earning. This Freedom is giving you a life in which you can live the way you want and can do the things you like most.

If you are really serious about creating your Financial Security then you must know your saved money & investments rightly and should know how much returns per month you are getting from your investments. Read this very useful article which will help you to find……

How can I maintain my Investments & Assets records by self ?