Economy of many countries have badly affected where Covid – 19 pandemic has spread widely. Due to this pandemic most of the businesses are on stand still mode. Income and cash inflow of almost all the small and large organizations have stopped. This is directly hitting profit of the organizations which may lead to pay cuts of employees and it may further leads to reduction in job opportunities.

This sudden stoppages of business are also affecting the business owner’s income and largely putting more burden on them on liability front which is creating fear in the business owner’s decisions to sustain the business in long run and to start the new business ventures.

Presently it’s starting point of the problem. If these restrictions on business and reduction in demand will continued then the problem can take worst shape in future.

The whole economy works on people sentiments, if sentiment is good people use to spend more due to their secured income and this will help to rotate money in people to people hands which leads to healthy economy. But if people sentiment have fear then people will spend less due to unsecured income and this is badly affecting the rotation of money from peoples to people hand which leads to bad economy.

This bad economy will not allow to retain the businesses, to start new business ventures and growth of new vision. The whole thing will finally reduce the earning opportunities either in businesses or in jobs.

Is migration will also Impact ?

Other major impact may arise due to people working abroad. In India for survival it requires less money as compare to western world. In any developed country like UK, US, Australia etc. to run the monthly expenditure you need to pay many EMIs & premiums which are totally depending on monthly earning. Without earning it is difficult to sustain abroad. So once restriction on international travel removes, many Indians will move towards India as the cost of living is much cheaper as compare to abroad.

You can take the best example of migrant labour in our country those are moving from city to villages just to sustain as city life is very expensive as compare to village.

Once this migration from abroad to India will happen the competition on earning opportunity like job, business etc. may be significantly increased and this will create more unemployment in India.

Importance of Social Security

In this crucial time one has to sustain with their current daily expenditure so the family basic financial needs can be fulfilled. This pandemic time is the right time to understand the importance of Social Security in such crucial period where monthly earning is very uncertain as business are in trouble and Jobs are also on risk.

What is Social Security ?

Our basic needs are shelter, food, health and few essential expenditures. If earning continues then all said needs take care off but if any risk on monthly income arise then we need Social Security which can only help us to sustain if any financial bad time comes in our life.

In India, especially middle class are not covered with any Social Security scheme run by the govt. which can fulfil the basic requirement to sustain. So it is very necessary to create corpus for social security by self.

What you should do to check your social security status ?

In this pandemic time where jobs and businesses are not secured, we need to check the money and investments available with us. This available money are going to help us to sustain in any kind of financially stressed period. So we need to analysis the investment made.

Now we generally investing either in short term investment options or in long term investment schemes. Short term means 5 years or less and long term means more than 5 years. Now in this crucial time it is important that how much invested money is available which can be in-cashed in case of emergency. This fund is your initial social security fund which can fulfil immediate requirement of money and also we need to assess the bare minimum expenses which can actually tell us that how long we can sustain with this initial funds of social security.

Further we need to look into our lock-in invest options of short terms as this also back bone of immediate after initial social security.

Now accordingly assess the current status of your initial social security and immediate after initial Social Security fund. This is all just to sustain the monthly bare minimum expenses.

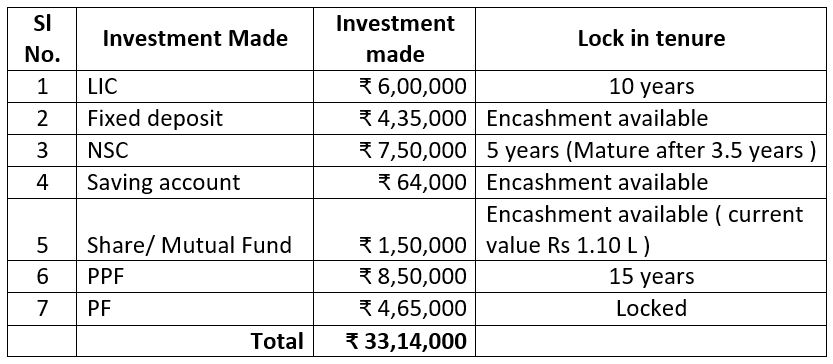

Take example to understand better To better understand we can take example of Mr John who has invested money in different investment options. His investment portfolio is…..

He has Rs 33.14 Lakhs in hand and his present monthly expenditure is Rs 30k per month. First he need to check the initial security fund which can be encashed. In this invest portfolio the initial security fund is available in Fixed deposit, saving account, Share/ Mutual fund ( Current value ) this comes Rs 6.09 Lakhs.

If his monthly expenses are Rs 30k then this 6.09 Lakhs can sustain around 1 Year 8 months ( 20 months). His next investment will be matured after 3.5 years ( 42 months ) i.e NSC. In his case he has no money for rest 1 Year 10 months ( 20 months ) . His investment is covering social security till 1 year 8 months only so he has to look earing opportunity much before ending of 1 year 8 months.

Many of us has similar problem or do not have sufficient fund for initial social security. Those have planned their investment wisely, for them managing this crises period is easy.

So what will help ?

The answer is that every individual has to create social security by themselves & his family and plan his funds accordingly so in case of emergency the funds can be available in form of cash money to sustain monthly expenses.

There are five steps to achieve the social security.

1st Step – Save equivalent to 12 month of your monthly expenditure.

2nd Step – Save equivalent to 50 month ( 4.16 years ) of your monthly expenditure.

3rd Step – Save equivalent to 100 months of monthly expenditure.

4th Step – Save equivalent to 150 months of monthly expenditure.

5th Step – Save equivalent to 200 months of monthly expenditure.

To understand better take example of the person who’s basic monthly expenses is Rs 30,000/- per month which includes all necessary expenses related to house rent, grocery & kitchen expenses, utility bills, kids education, clothing and other basic needs.

To reach at 1st Step you need

Rs 30,000/- X 12 Months = Rs 3,60,000/-

To reach at 2nd Step you need

Rs 30,000/- X 50 Months = Rs 15,00,000/-

To reach at 3rd Step you need

Rs 30,000/- X 100 Months = Rs 30,00,000/-

To reach at 4th Step you need

Rs 30,000/- X 150 Months = Rs 45,00,000/-

To reach at 5th Step you need

Rs 30,000/- X 200 Months = Rs 60,00,000/-

So we need Rs 3.6 Lakhs just to sustain for 12 months, need Rs 15.00 Lakhs to sustain for 4 years- 2 month and need Rs 60 Lakhs to sustain for around 15 years. This saved money also gives us mental strength to explore the new avenues of life.

This is how we can reach to the target corpus for complete social security. You can check status of your social security here.

It is necessary to check your social security status in this crucial time and if you find any gap then try to fill the gap by correction in investment planning and saving further for Social Security which only make our life stress free.