We are hesitant to start saving for social security but it is know fact that we are living in the world where money is very impotent element to live the life. We cannot ignore the importance of money. By knowing this fact we should be more vigilant to earn and to save money. If this saved money can secured all our basic needs then we are well protected and this is how social security word has big significance in our life.

Social security is the only shield which can protect us in our bad time. It is very important to check that how much we are protected with any schemes running in our country and whether those schemes will protect us in bad time specially when we do not have any money or earnings.

What major things we are looking as social security

- Shelter

- Food

- Healthcare

- Clothing

- Money for daily basic expenses.

These are first basic things comes in our mind and if these things are covered by any means then we are socially secured. Many countries where all these are taken care by some schemes where if we are citizen of the country then we are getting it. But if in our country we are not getting these then it is important to create the social security by self.

To get this cover we need money with us so in case of emergency we can take care of all our basic and emergency need.

So how much money we need for Social Security

We have seen in the article “Check status of your social security” in detail how we can check our present social security status and also understood how much money require to cover our social security. We also seen that which are the major tools can help us to create our social security in article “Nine tools to build social security”.

This all things are driving the conclusion that our saving habits can only help us to secure social security and in later age allow us to lead life financially free.

We all are earning money and spending for our requirements and to maintain our lifestyle. We should wisely choose things before buying as everything comes with cost and this cost will empty our pocket very fast so we should be more determine towards the saving which only can strength our confidence to lead life.

If you create habit of saving in you, doing things in later age will be much easier which will help you to create decent amount for all your emergencies. Small saving and investing in right investment plan are having immense power in longer run which will gives you unbelievable returns.

Why do we save money ?

In present world money has placed its position very well and now we cannot ignore importance of money. In bad time our savings will only help us & our family to sail smoothly. We need money for social security and if saving little amount can create security of self & family we should take little pain to save it.

Then why we are hesitant to save money ?

By knowing all these facts still we are hesitant to save money. Many reasons are stopping us to save money for social security and financial freedom too. When we are calculating the required corpus for social security or financial freedom then we are drawing the conclusion that for saving such big corpus amount is not possible with present earnings and this is stopping us to go forwards and then we are just giving excuses to convince himself that.…….

- Saving small amounts cannot make much change in life.

- On small savings return will be very small.

But the reality is different. We should understand that the process for saving such large corpus required 20-25 years where your saved money and interest earned over it will create big corpus. By our regular job we cannot create such large corpus overnight. Or if we want to achieve in 2-3-5 years then we need to look into the alternate source of fast income like business where risk are also involved but same time it will help us to achieve our goal faster.

If any time we fails to achieve the goal of social security or financial freedom even then we will be left with large savings which will give us reasonable income per month and same time saved amount will help us to lead life confidently.

Saving small amount can make significant changes in life

Small regular saving has great potential to build big amount for social security in longer run. If we save money regularly and same time invest in good investment plans then we can able to build heap of corpus for our social security which will protect us and our family in any unfortunate bad time.

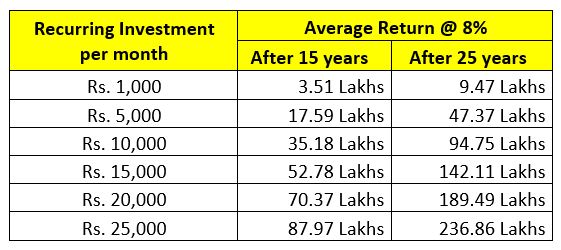

We can see here how small saving and investing in reasonably good investment plan can create good corpus for social security. By regular recurring saving of 1K, 5k, 10k, 15k, 20k & 25k are creating good corpus amount as per given table. Here you can see as much you increase you savings, your returns on investment is increasing drastically.

Here you can set you monthly saving target also

The saving habit will help us to create fund for future. We need to set the target of monthly saving which we can able to do every month comfortably. After setting the target we can start saving regularly and do it without fail. Doing this regular savings religiously can big way help us to create big corpus.

In 15 years : If we are setting up the target to save Rs 10k per month regularly then after 15 years we will get Rs 35.18 Lakhs in which saved amount will be Rs 18 Lakhs and interest earn will be Rs 17.18 Lakhs

Rs 10,000/- X 12 Months X 15 Years = Rs 18 Lakhs

And Interest earned will be = Rs 17.18 Lakhs

Total = Rs 35.18

In 25 years : If we continue this saving of Rs 10k per month regularly till 25 years then interest component will be very much higher. After 25 years we will get Rs 94.75 Lakhs in which saved amount will be Rs 30 Lakhs and interest component will be 64.75 Lakhs.

Rs 10,000/- X 12 Months X 25 Years = Rs 30 Lakhs

And Interest earned will be = Rs 64.75 Lakhs

Total = Rs 94.75 Lakhs

Set you target here accordingly

We can set monthly target as much we can save comfortably. This will be for our social security and it should be invested in only secured investment option. If we can able to save more than this then you can invest in medium secured and Risk options to fetch higher returns.

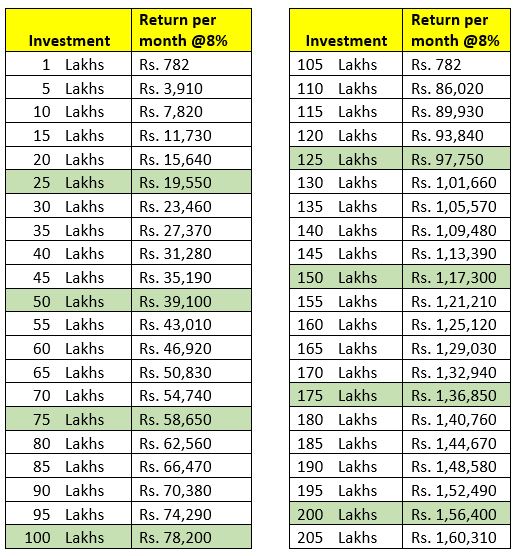

If we have already saved some money then we can fetch return by investing for 5 years and generate monthly income which we can further reinvest for another 5 years of block period. See the table….

By doing such planned saving will only help us to create good corpus in long run.

By looking at all the aspects we should understand that the power of savings and compounding will help us to secure our social security and will help us & our family to lead life comfortable & stress fee.

“So don’t be hesitant to save money and try to save as much you can”