Living up your dream life can become much easier when we will focus on what we want to achieve. Deciding the goal and further follow up to achieve both are equally important. Sometime goals are tough and sometime easy but even for easy goals if you will not focus then it will become difficult to achieve.

Same way if we are setting up the target to get financial freedom we need focus to our goal and it will happen when we have self-discipline towards our regular savings & investments.

So what is required is discipline in savings & investments so the target to achieve the goal will become easy.

How discipline in investment can help ?

After deciding your goal you should religiously follow up the way to achieve and if way is long then it is more difficult to keep focus on goal. Here we are talking about to get financial freedom. We have 20-25 years is hand to achieve this. Even the long time can be reduced if we focused well and do regular work on this. Earning money has major role in this but if saving & investment has no discipline then it will become difficult to achieve the goal of financial freedom. To make it easy, planning and discipline in investment review at regular intervals will make goal easier.

How to plan the investment ?

Once you decide the corpus amount to get the financial freedom you have to plan the investment schedule for corpus. This plan you have to follow 20-25 years without deviating. We can do minor changes in investment plans and accordingly monthly & yearly investment can be done regularly so the compounding benefit of interest will enhance and growth of money will be at faster pace. This only can be achieve when we regularly look into our schedule and do the disciplined investment without fail.

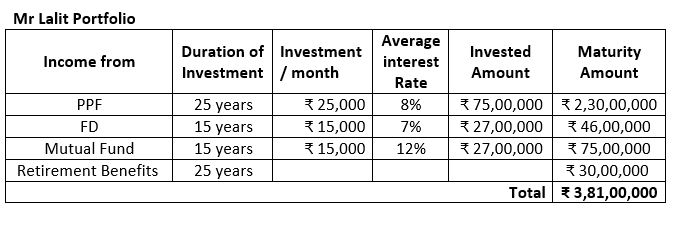

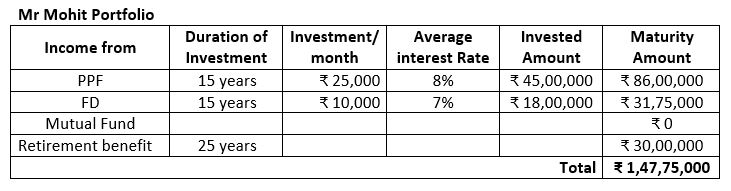

To understand better how discipline in savings & investment works we can see the example of Mr Lalit who is disciplined person and Mr Mohit who is little lazy and not focusing.

Comparison of Mr Lalit and Mr Mohit investing habits

We will see the importance of discipline in saving & investment. To better understand take example of Mr Lalit who is very disciplined and regularly saving money as per plan and checking up the status of his investments and also conscious about market up-downs. In other side Mr Mohit is lazy and not regularly monitoring his savings & investments neither looking into market trends.

Mr Lalit & Mr Mohit both has targeted the corpus amount around Rs 3.75 crore with same planning from which they will going to generate the minimum income of Rs 2 Lakhs every month.

Mr Lalit has planned that he will invest money in PPF for him & his wife name and started investing Rs 12500/- in each account i.e together 25,000/- per month and he has started this at age 23 year. He wanted to achieve the target corpus of 3.75 crore at age 45. He is started investing Rs 25k per month on regular basis in his and spouse PPF account. After around ten years of service his income increased and he is saving regularly around 55k per month altogether after his regular expenses of 35k per month & home loan EMI of 20k. Also regularly he is getting good increment in his job and earning more money. As he is very much disciplined and regularly investing money in PPF, bank FD and Mutual fund/ systematic investment plan (SIP). After 25 years his return of investment portfolio.

Mr Lalit has achieved his target at age 45 but he is continuing till age 47 and got corpus of Rs 3.81 Cr corpus for financial freedom.

Mr Mohit has planned same way as Mr Lalit wanted to invest money in PPF for him & his wife name and started investing Rs 12500/- in each account i.e together 25,000/- per month and he has started this at age 23 year. He also wanted to achieve the target corpus of rupees 3.75 Cr at age 45. He has plan to invest money monthly. After around ten years of service his income increase and he is planning to saving around 55k per month after his regular expenses of 35k per month & loan EMI of 20k. Also regularly he is getting good increment in his job and earning more money. As he is not disciplined and always fantasized with luxury and spending money on buying expensive goods. Also he is not regularly watching trend of market so not able to decide where and when to invest.

Mr Mohit is thinking that saving Rs 25k per month in initial 10 years will be bit difficult so he will start saving in PPF after ten years only. After ten year has started saving Rs 25k monthly in his & his wife’s accounts regularly. Also he has able to save only Rs 10k of his earnings due to his spending habits which he is investing in Bank FD only as he do not want to search market trends. Now we will see his investment portfolio after 25 years.

If you compare between Mr Lalit & Mr Mohit both has same goals with same planning but Mr Lalit is very much disciplined in investment and investing money regularly as per plan and has timely achieved corpus of Rs 3.75 crore. In other side Mr Mohit is good in planning but not disciplined in savings & investment hence after 25 years Mr Mohit is not able to saved required corpus so he can able to lead his life by own way without any fear. In above case Mr Mohit lost Rs 2.33 Cr just because of his non disciplined attitude. A small focus on you goal can make significant change in your life.

This is the example of Mr Lalit & Mr Mohit but most of us are not even planning or thinking to create corpus so our condition is worst than Mr Mohit.

So its high time and without wasting time you should start saving and investing money based on your assured earning ( less or more ) and on basis of your monthly needs you can decide the corpus amount and start saving and investing money in right investment plans. Even if your age is more also but still you can create good corpus if you are earning regularly.

From the above we learnt that ESI is the only formula to achieve your goal for financial freedom i.e Earn, Save, Invest Three thing we have to follow

- You should have disciplined to Earn money

- You should have discipline to Save money

- You should have discipline to Invest money

If we follow this formula you can create good amount of corpus which will be for your social security and help you to lead the life confidently.

Read more……..

Ten smart small sport bags help to gear up your lifestyle

8 Hobbies which add value to our lifestyle

Good information.