We all want to achieve financial freedom as early as possible and it will happen when we work hard and can able to save decent amount of corpus. But its big question what is decent corpus amount?

When we try to search we found someone is suggesting 5Cr, 4Cr, 3Cr, 2Cr, 1Cr…… For us achieving this amount is possible?

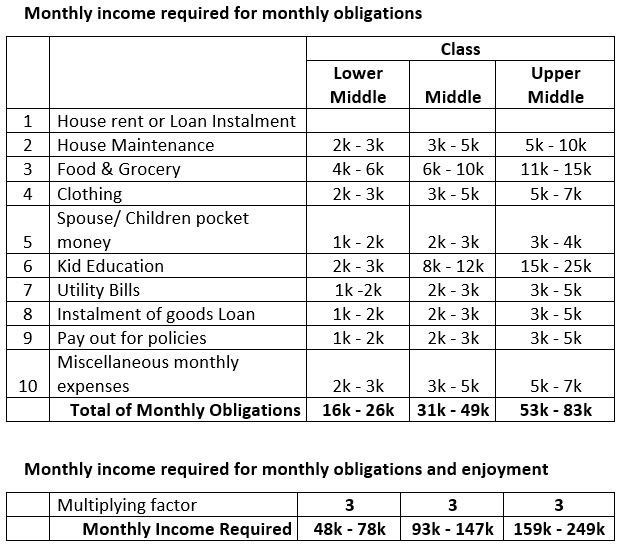

To decide this amount we have to decide our type of lifestyle which we wanted to live either simple peaceful life or luxury life. Based on which we can able to decide what should be the monthly income when we don’t work which can able to fulfil monthly obligations and also sufficient to enjoy the life comfortably. We have to categorise our self which kind of life style we want to live in. To understand better we have divided in three classes

- Lower Middle Class lifestyle

- Middle Class lifestyle

- Upper Middle class lifestyle

Now we have to decided and calculate what will be our obligations when we will be loaded with responsibilities of family. The tentative amounts of monthly obligation are as under which may differ person to person based on their responsibilities.

This multiplying factor will take care of present rate of inflation. Although the inflation is not fixed. In 25 years it may increase or chances to decrease or there will be no inflation. Which actually can be known in real time.

So we have to decide what monthly income we need which can take care of all obligations and money to enjoy life when we don’t work. After deciding we have to work out the corpus amount which can generate sufficient income.

Why corpus should be invested in Secured investment options ?

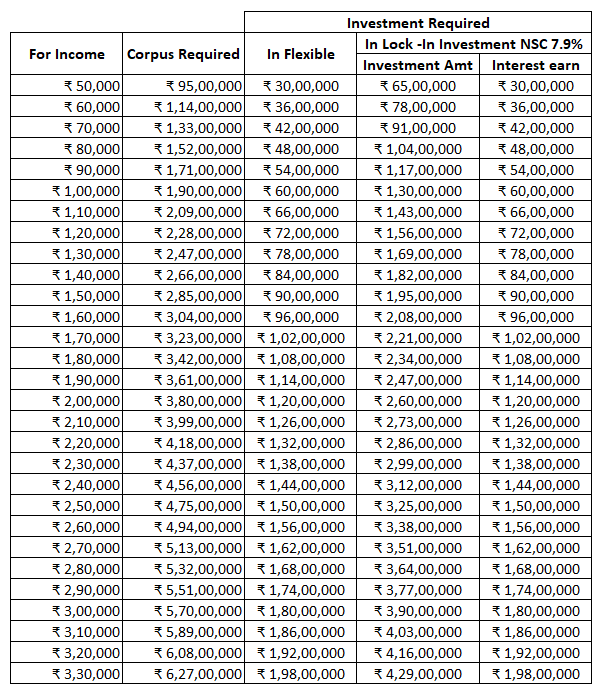

As we all want to live peaceful stress-free life then it is important that this corpus can be invested where invested money and returns are very much secured. We read about secured investment in article “Investing money in right direction” where we learnt that in secured Investment the returns are less but the investments are secured. End of the investment tenure you will get the money which can be further re-invested again in secured investments. Now as we need regular monthly income, we can invest part corpus amount is flexible option like bank FDs where any time money can be withdrawal and part can be invest in long term investment plan like NSC where lock in period will be there less and also returns will be more.

How much should be kept in Flexible and how much in Lock-in options

According to long term investment duration, the flexible investment amount can be decided. For example if we need Rs 70,000/- per month monthly income without working and here suggested lock in period is 5 years and investment option we are choosing NSC which is presently giving interest @7.9% annually compounded. As we need Rs 70,000/-per month till 5 years for expenses so actually we need Rs 70,000/- X 60 months = Rs 42 Lakhs in five years which should be invested in flexible option like FD so till 5 years Rs 70,000/- can be withdrawn every month. Now we can arrive long term investment amount which should be such which can generate 42 Lakhs interest in 5 years so after maturity period of 5 year interest can again utilise in further 5 year’s expenses. If we invest NSC like investment tool then in 5 years 7.9% interest rate 91 Lakhs investment will generate assured 42 Lakhs interest. The total required corpus will be 91+42= 133 Lakhs. See the 3rd row in table below.

By in large you need big corpus amount to live our life comfortably. Creating corpus is not a big chunk if timely investment plan can be implemented and in longer periods like 25 years it can be easily achievable.

Above investment option is one of the safe option. Based on the above logic many other options can be explored, Lock in period should be less otherwise we need big corpus to generate required interest. Also saving at secure option will give us piece of mind so always suggested to go with any option which should be secured.

Taxes on interest earned

Investing amount on single will attract more tax liabilities on interest earn which can be reduced by investing part amount on the name of our spouse.

Once to set your corpus amount based on your monthly earning requirement, you can focus to save money for corpus amount. Your small saving in long term will create big amount which will generate passive income so you can live your life peacefully without thinking to earn money.

You can learn more about in article “How to create big corpus for financial freedom from small savings”.

Good