If you are looking to invest money in well secured investment option then Post Office & Bank Fixed Deposit schemes both are the best investment tool to enhance your investment reasonably.

Post office which is run by Department of Post – Ministry of Communications Government of India which is well-secured investment option and also interest rates are reasonably good as compare to other secured investment options.

Although Nationalised banks are well secured as compare to Private & Co-operative banks.

How good is Fixed Deposit ?

Fixed deposit schemes are very good investment tool. Majority of fixed deposit schemes of Post Office & Banks are especially most popular due to few reasons

- Fixed returns

- Any time money can be withdrawn

- Reasonable returns

- Reasonably secured

- Secured principal amount

- Shorter Tenure

- Unlimited investment can be made

Due to Covid-19 pandemic impact, most of the investment markets are struggling and there is risk involved investing in non-secured investment options. So in the present scenario, Fixed Deposit schemes are reasonably good and well secured.

Is any Impact due to pandemic ?

Since March 2020 due to Covid – 19 , the interest rate of the fixed deposit schemes are slash down drastically especially after March 2020. This sudden drop in interest rate has impacted both the post office and bank fixed deposit return on investments.

You can compare the rate of interest before 31st March 2020 and present interest rates on 1 year FD & 5 year FD.

As the interest on deposits has been drastically decreased due to which the income on investment has also drastically decreased.

In prevailing circumstances, it is good to have investment in FD which can fetch more returns on investments, but before investment, let’s know more about fixed deposit of Post office & Bank.

Post Office Fixed Deposit

Fixed deposit investment schemes run by Post Office are commonly known as “Time Deposit Account”. The available investment tenures are 1 Year, 2 Year, 3 year and 5 Years. The features of time deposit are reasonably good.

This scheme is good for deposit for the shorter duration where scheme is offering 1,2,3 years of fixed deposit schemes of lock-in-period of six months. Also one option for longer duration is also available for 5 year of lock-in-period where interest rates are at the higher side.

Duration – 1,2,3,5 years

Minimum contribution – Rs 1000/- and in multiple of Rs 100/-

Maximum contribution – No limit ( should be multiple of Rs 100/- )

Interest rate – For 1, 2, 3 years – 5.50% per annum (quarterly compounded)

For 5 Years – 6.70% per annum (quarterly compounded)

Interest after maturity – Taxable

80C benefit – Only on 5 year time deposit

Salient Features –

(a) Who can open :-

(i) a single adult

(ii) Joint Account (up to 3 adults) (Joint A or Joint B)

(iii) a guardian on behalf of minor

(iv) a guardian on behalf of person of unsound mind

(v) a minor above 10 years in his own name.

Note:- Any number of account can be opened.

(b) Deposits :-

(i) Account type for 1 year, 2 year, 3 year, 5 year.

(ii) Account can be opened with minimum of Rs. 1000 and in multiple of Rs. 100. No maximum limit for investment.

(iii) Interest shall be payable annually, No additional interest shall be payable on the amount of interest that has become due for payment but not withdrawn by the account holder.

(iv)The annual interest may be credited to the savings account of the account holder by submitting application.

(v) The investment under 5 year TD qualifies for the benefit of section 80C of Income Tax Act, 1961.

(c) Maturity :-

(i) Deposit amount shall be repayable after expiry of 1 year, 2 year, 3 year, 5 year (as the case may be) from the date of opening.

(d)Extension of Account :-

(i) On maturity depositor may further extend TD account for another tenure for which account was initially opened.

(ii) TD account can be extended from date of maturity within the following prescribed period.. 1 year TD = within 6 months of maturity. 2 year TD = within 12 months of maturity. 3/5 year TD = within 18 months of maturity.

(iii) At the time of opening of account depositor can submit request for extension of account from the date of maturity.

(iv) TD account can be extended after maturity by submitting prescribed application form at concerned Post Office along with passbook.

(v) Interest rate applicable to respective TD account on the day of maturity shall be applicable to the extended period.

(e) Premature closure of Account :-

(i) No deposit shall be withdrawn before the expiry of six months from the date of deposit.

(ii) If TD account closed after 6 month but before 1 year, PO Savings Account Interest rate will be applicable.

(iii) If 2/3/5 year TD account prematurely closed after 1 year, interest shall be calculated 2 % less than of TD interest rate (i.e. 1/2/3 years) for completed years, and for part period less than a year, post office Savings Interest rates will be applicable.

(iv) TD account can be closed prematurely by submitting prescribed application form with pass book at concerned Post Office.

(f) Pledging of TD Account :-

(i) A TD account may be pledged or transferred as security, by submitting prescribed application form at concerned Post Office supported with acceptance letter from the pledgee.

(ii) Transfer / pledging can be made to the following authorities.

- The President of India/Governor of the State.

- RBI/Scheduled Bank/Co-operative Society/Co-operative Bank.

- Corporation (public/private)/Govt. Company/Local Authority.

- Housing finance company.

(g) Advantages –

(i) Time deposit are fetching more returns as compare to Bank Fixed deposit schemes.

(ii) No limit on investment.

(iii) Shorter tenure

(h) Dis advantages –

(i) Online facility of making Time deposit is presently not available.

(ii) Only four option of tenure available.

(iii) Minimum lock of Six month.

(iv) Auto renew separate request to be made.

(v) Premature closer attract more penalty as compare to bank.

Bank Fixed Deposit

Fixed deposit investment schemes in banks are commonly known as “Fixed Deposit” almost in all the banks. The tenures are starting from 7 days to 10 years. The feature of bank fixed deposit are reasonably good like Post Office Time Deposit. More tenure options are available for investment.

The schemes are good for deposit for the shorter duration although schemes are offering shorter period of 7 days to longer period of 10 year.

Duration – 7 days to 10 years ( Duration differs bank to bank )

Minimum contribution – Rs 100/-

Maximum contribution – No limit

Interest rate – Starting from 3% to around 7%. (Quarterly compounded)

Interest after maturity – Taxable

80C benefit – Only on 5 year Tax saving Fixed Deposit.

Salient Features –

(a) Who can open :-

(i) a single adult

(ii) Joint Account (up to 3 adults) (Joint A or Joint B)

(iii) a guardian on behalf of minor

(iv) a guardian on behalf of person of unsound mind

(v) a minor above 10 years in his own name.

(b) Deposits :-

(i) Deposit tenure starting from 7 days to 10 years.

(ii) Account can be opened with minimum of Rs. 100 and for maximum amount there is no limit.

(iii) Interest shall be payable after maturity. Even after maturity, the fixed deposit will get automatically renewed for the same tenure if pre instruction given at the time of making deposit.

(iv) The interest may be credited to the savings account of the account holder after maturity if instruction given at the time of deposit otherwise it will get renewed with interest amount with same tenure if instruction given.

(v) The investment under 5 year Tax saving FD of lock-in-period is qualifies for the benefit of section 80C of Income Tax Act, 1961.

(c) Maturity :-

(i) Deposit amount shall be repayable from 7 days to 10 years from the date of opening as per bank offered schemes which will differ bank to bank.

(d)Extension of Account :-

(i) On maturity, the fixed deposit will get auto renewed for same tenure if instruction given at the time of making fixed deposit.

(ii) At the time of making fixed deposit, depositor can submit request (online or in application form) for extension of account from the date of maturity which will be applicable for same tenure or tenure chosen.

(iii) Interest rate applicable to respective Fixed Deposit on the day of maturity shall be applicable to the extended period.

(e) Premature closure of Account :-

(i) The deposit may close any time from the date of deposit before maturity period. (ii) Premature closer will attract penalty on interest.

(iii) Fixed deposit can be closed prematurely by online or submitting prescribed application form with Fixed deposit certificate.

(f) Pledging of TD Account :-

(i) A Fixed deposit account may be pledged as security, by submitting the prescribed application form at the concerned bank.

(ii) By pledging, the loan can be availed in same bank where Fixed Deposit has been made.

(g) Advantages

(i) Most of the banks are offering online facility for making Fixed Deposit.

(ii) Banks are offering many tenure options.

(iii) Any time money can be withdrawn.

(iv) Loan on FD option available in almost all the banks with very less formalities.

(v) No lock-in period except Tax Saving Fixed Deposit.

(h) Disadvantages

(i) Fetch less returns as compare to Post Office.

(ii) Less secured compare to Post Office

Income – Post Office Vs Bank Fixed Deposit

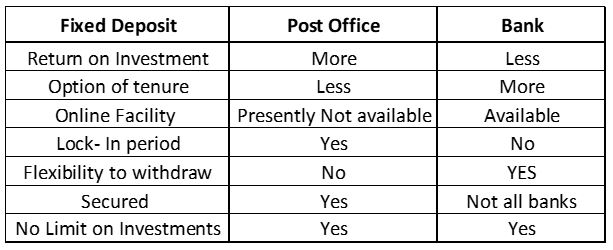

Features – Post Office Vs Bank Fixed Deposit

Now by knowing all the features, the investment can be planed based on individual requirements.

The returns on investment are reasonable in both the options of Post Office & Banks, Post office returns are little higher and same time it is well secured. Flexibility to withdraw is making Fixed Deposit more popular. It is a good & safe tool to enhance our hard earn money.