We all need money to live stress free life so we can enjoy our time peacefully. To get this we need big corpus amount which can generate sufficient income so we can fulfil our monthly obligations and money to enjoy life.

Is this required big savings ?

No if we do small saving regularly or monthly even then small saved amount can create big corpus in long period if we invest this saving in right direction. Will see how small amount can create big corpus.

We know that we have to work hard to generate big corpus from our monthly earnings. Most of us either doing service or doing business. By working we are getting monthly income from which we are running our family needs. We always spending our whole money on family needs & living good life but not much focusing on saving, always making list of the items to be purchased which actually shelling out money from our pocket. Also we are thinking that small saving will not much help us in future so better to spend and enjoy life. As we are not saving sufficient amount for future, we are working till our old age to run daily expenses and family obligations. Our most of the time and energy are going to earn & meet obligations, we are not able to do many things in life like traveling, likable work, live up life with passion, hobbies etc.

This hard work we are doing from age 21 to 65 years of age around 45 years just to earn money to meet our daily needs. If we do smart investment on monthly basis then after 25 years we need not to work for money. After 25 years we will have sufficient income from our saved money so we need not to spend our precious time for earing money. We can use our time to live life the way we want.

Decide what should be the corpus amount needed-

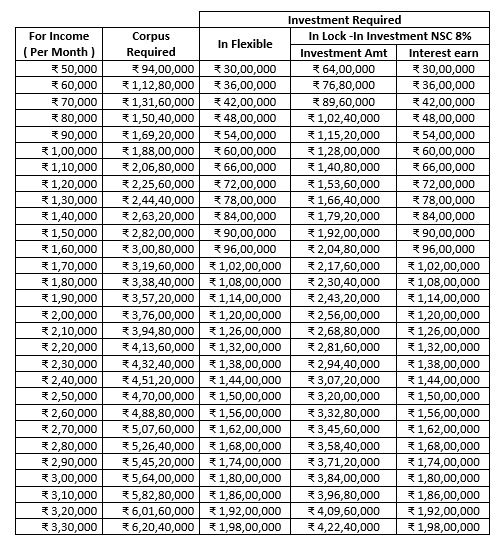

We read in article about “How much corpus we need for Financial Freedom” in detail. Based on our obligation and requirement we have to decide how much income we required per month. Below table will help us to find corpus required for monthly income starting from 50k per month to 330k per month.

Once you decide corpus amount required for you then accordingly you can set your target and make a saving & investment plan.

How to create big corpus by small savings

After deciding the corpus amount we should know how small saving can create big corpus. If we invest 25k per month till 25 years then after completion of 25 years the corpus will be around 2.28 Cr which can generate income minimum around 1.25 lakhs per month. This corpus will be with you which will generate income when even you don’t work. Also having such big corpus amount will give you confidence to lead life.

In early age it may be difficult to save 25k per month but if you work hard and make it happen then in later age contribution of 25k will be much easier.

How it Works ?

Public Provident fund ( PPF ) a government of India operated savings and investment scheme is the best tool to multiply your money where your money is almost secured, returns are reasonable and interest is tax free. A PPF account matures in 15 years and you can extend it in blocks of 5 years each. You must extend the tenure within one year of maturity. You can open a PPF account with as little as Rs. 100. However, you must deposit a minimum of Rs. 500 in a financial year, and a maximum of Rs. 1,50,000 per financial year. You can also choose to deposit the money as a lump sum or in instalments, which must not exceed the limit of 12 instalments per financial year.

So you can invest per month Rs 12500/- in your PPF account till maximum limit of Rs 1,50,000/- per financial year. As we have to invest 25k per month, we can open other account of the name of your spouse as one individual can open one PPF account in any bank or any post office. Present rate of interest is 7.9% compounded yearly. This interest rate is flexible. The government of India is changing interest rate time to time. For calculation purpose we are considering average interest of 8% throughout the entire period. If we invest Rs 12500/- per month in one PPF account then we will get the returns after 15, 20, 25, 30 years are as mentioned below.

If monthly we continuously saves money till 25 years in PPF account then it will create big corpus

In 25 years

After maturity of your PPF account = Rs 1.14 Cr

After maturity of spouse PPF account = Rs 1.14 Cr

Total After maturity = Rs 2.28 Cr

In later age even if you can able to save more than 25k, which you can invest in Bank FDs or any other secured/ unsecured investment options where return are at higher side. This you should fix which will create your social security at age 45-50. All together you can create big corpus amount which can generate more regular monthly income when you don’t work. Compounding has immense power which can multiply you saved money.

Don’t waste time and start monthly small savings which help you to create big corpus in the future and secured your money needs.

Thank you sir.

Yes starting savings at the Early age is good. I started PPF and also SIP already. Happy to discuss about the these savings.

Thank you so much Vivek Sir for this great post. It is so informative! I really appreciate this information, it helps me to plan a better future and to focus more on saving. I really didn’t know the magic of PPF, it has been made very simple to understand, this is something so unique, safe and wonderful investment that is going to help me to create a big Corpus from small saving. After reading completely I understood that compounding has immense power. I am surely going to open my PPF account. Thanks a lot Sir