As we all know that passive income can only give us financial freedom to enjoy life. So first we should know how much money we need per month to fill our monthly obligations. This may differ person to person based on their lifestyle liabilities and age.

Rich people have enough money to decide their lifestyle easily but upper middle class, middle class and lower middle class are deciding their lifestyle based on their income. If lifestyle is at same level or lower than that then the probability to achieve financial freedom will be easier.

Now it’s time to decide which type of lifestyle we want to live in which we will be most comfort and also it should be achievable to get. Accordingly we will decided how much money we require. That exercise we should do honestly, if we do that then we can focus to achieve the goal to create passive income corpus or assets which can generate monthly passive income. So we should choose future lifestyle keeping in mind that we can able to create corpus for financial freedom with less stress. Just for understanding bifurcation of classes.

- Upper middle class

- Middle class

- Lower middle class.

After deciding type of living, we need to define and should make list of major monthly obligations for which we actually require monthly income. Then also workout per month how much money we need to enjoy good decent life.

Money required for Needs

Few are the major heads which draining our income and actually our hard eared money is going.

- House

- House maintenance

- Food/ grocery

- Clothing

- Spouse

- Kids Education

- Utility bills – Telephone, Water/Property Tax etc.

- Instalment of Loans if any

- Premium pay-outs for Insurance

- Liability of parents if any.

- Miscellaneous monthly expenses

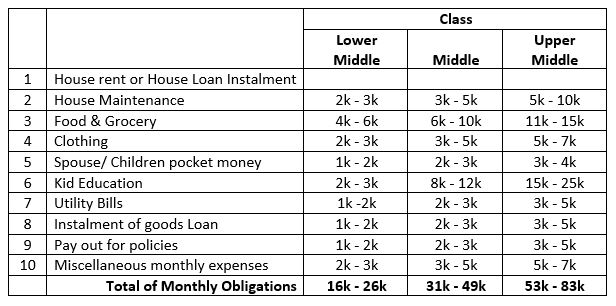

If you are having your own house or parental house or house provided by company then our tentative expected expense will be tentatively.

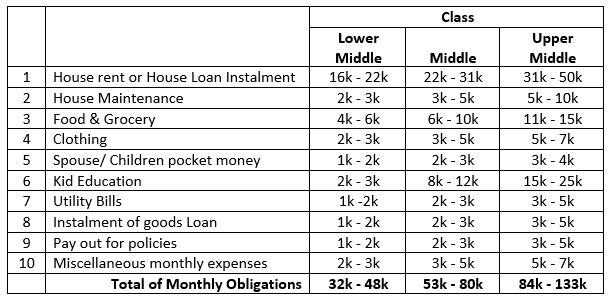

If you don’t have house or living in rented house than your monthly obligation cost are at higher side.

It is always advisable to keep you expenses low so saved money can be invested to create corpus which can generate passive income. As much we save, it generate more compounded interest which grow your money very faster.

Also one to decide at what age he/she wanted to get sufficient income so accordingly target for saving can be made.

What we need “Roti” “Kapda” & “Makan” means Food, Clothing & House are the major head of expenses in our life. Few other things are also has significance like medical expenses either consultation fees, medicine or hospitalization and kids education. If any corpus can take care of all this five major heads of expenses then only left with very nominal expenses. These major heads are

- Food

- Clothing

- Housing

- Medical

- Kid Education

Housing – Majorly we always invest our hard earn money to buy expensive house. It is important that we should have one house anywhere in country and which should be reasonably priced with good surrounding. Also investing high amount of money is not advisable until we get some good earnings otherwise whole life will go to pay EMIs to the banks. If we avoid indulging to get more liability of loan, then metal stress will be less and we can focus to save money for corpus for passive income. If you have your house gifted by your parents then you don’t need house but if house is provided by company or you are residing in rental accommodation then you have option to buy house in the city or location where either your near & dears are there or where you want to settle. This house you need for shelter in case of emergency or for your bad time.

Medical – Same way for hospitalization we have option to take health insurance which cover all our medical needs. Choose health plan carefully so all hospitalization need can be covered. Medical consultation fees and medicine expenses can be reduced If we take less stress in life and keep our mind cool and stress free. If your job covers all your medical need then you don’t required this also.

Food – Food expenditures like grocery, vegetables, fruits etc. are market driven as their prices are changing based on location / availability. Only we can control on wastage which may eat our hard earn money.

Kids Education – Now a days kid’s education is becoming major expenditure as fee structures are gone up so high. We should choose school where best education can be given with reasonable fee. This saving can help in later years to get higher education for our kids.

Clothing – Clothing is very essential element in our expenditure list as this may create impression in society and gives you good feeling. In this world we can create best impression by wearing good clothing. Buying at right place and on right time can save lot of money. If we shop during discount season we will get best offers. Now a days online shopping options are also available on online shopping websites like Amazon Flipkart etc where reasonable priced clothing can be purchased. Even few shop across city are offering best prices which we need to find out.

Other than above few of the expenditure are one time expenditures which we may do some point of time in life. These are important for us and may differ based on our lifestyle and society where we are living in and these are

- Dream House

- Children Marriage

Dream House –To buy dream house we required good amount of money. It is always advisable to invest in suitable house which is comfortably to our pocket even if it’s not much of our dream house. Because at later years we can sell this house at good rates and can add more amount to take our dream house. In later age our income will be more, so taking dream house may be much convenient.

Children marriage – Children marriage is also requires good amount of money. As most of us has dream for good marriage for out kid either girl or boy. Although now a days we all are conscious about our kid’s education which help them to settle him/herself by own. But still in our society parent are playing big role in children’s marriage. This liability will fall into our later age generally after age 50, by that time if we can able to collect required corpus in which partially can be used for children’s marriage.

As much you increase your needs it will be difficult to collect corpus for passive income. As much you save it will help you to create big corpus so rest of the life you can live peacefully.

Read More…..

“How much corpus we need for financial Freedom”

“8 hobbies which add value to your lifestyle”

“Way of dressing has major role to improve you personality”

“Ten Smart Bags for daily use help gear up your lifestyle”