We all need freedom in life so we can enjoy our time peacefully the way we want. In our life we need money to first take care of our liabilities and rest money is to enjoy our life. Every day we need money and to earn this money we need to do work hard.

Any profession we need minimum eight hours for work and if we consider traveling and preparation time to go to work place we are spending almost 11-12 hours a day. Our most of the energy is going in this only. Also while doing work we are getting lot of stress which is not allowing us to live life peacefully.

If this money comes to us in easy way without working, then we can save time and avoid metal stress which we can utilise to enjoy life. So what we need

- Enough money to fulfill liabilities.

- Enough money to enjoy life

- Time freedom

- Stress free life

So in short we actually need

- Financial Freedom

- Time Freedom

- Stress Freedom

This all three together gives us a peaceful enjoyable life. To get time & stress freedom first we need to get financial freedom.

So how much money required?

We have to work out first how much money we require to fulfill monthly obligation which has been elaborated in article “how much money is sufficient for our needs“ in details.

Now how much money we require to enjoy life ?

It’s time to find out what we want to do in life. Our brain is always active to do something for passion, live peacefully, taking rest, do spiritual things…..and many more. Just think what we will do if we get all these three freedoms.

- Will do something which is of our passion

- Will do the work which we likes more.

- Travel the places/ world

- Spend time with our kids & family.

- Spend time with friends

- Work for charity

- Take complete rest

- And if we have other dreams to fulfil

Every human want to do something in life starting from spend time with family & friends, do some adventures, travel the places, hobby, research, work, business, help society, charitable works, live spiritually…………take complete rest etc. Also we want to do these things with stress free mind. For few things we need money and for few we need time only. So it’s important to find what we want to do and accordingly how much money we need to get these things comfortably. Take some contingencies also if in case it attracts more expenditure.

Target should be achievable

It’s also important while calculating money requirement for needs and for enjoyment, the set target should be achievable. If we keep our budget big then archiving target will be difficult and more stressful. So keep both minimum & maximum requirement in such a way so at least minimum can be achieved. There is no end for our expectation, requirements & dreams. See and try to fulfil those dreams which is practically achievable and will able to give us peace of mind rather than luxury.

Target should be achievable at right age

Also it’s important that we should achieve all these at right age. Decide the age to achieve target, it should be less than age 50. If our saved corpus is able to full fill only our needs comfortably and hardly left money to enjoy life then still you consider that you have achieved your target.

How your skills will help during financial Freedom time

Most of us start working from age 20s – 25 and working till 40s – 50s we are continuously working to earn money and during this period we are learning many skills in our professional carrier. These skill can later pay off during our enjoyable life period. If we are feeling any point of time in life that in planned target age we can only able to collect corpus which generate monthly income for fulfill our monthly obligations for needs comfortably but not able to generate income to enjoy life then Its right time to polish our skills and look for option to do the work of our skill set which can generate income to take care of our enjoyment needs. This we have to start early as it will generate income after 2-3 years when we can able to establish in profession. This work should not have time bonding or restrictions so we can live-up our time freely.

For example if we are working in Software Company and during our carrier we have created many software for our clients. Now during our financial freedom time in a year one-two freelancing software project gives the income which will be sufficient to generate income which can take care to enjoyment needs of our life. The work may take 3-4 month in a year will be fine. Many skilled & non skilled works are providing such kind of opportunities. Sometime our hobby or talent will also give us incredible income sources. In this internet world we can work across globe sitting at one place. We can serve our skill to anyone across globe.

If we are getting good income by freelancing works, we can spend required money to enjoy the life and rest we can keep to create corpus for future years.

Many time we feel that we will not able to achieve goal of collecting required corpus, but only hard work and smart work can give way to achieve our goals may be it will take few year more than what we have targeted.

So how much money we need for enjoyment ?

During financial freedom time other than to run monthly expenses for needs we need money to enjoy. To enjoy the life any amount is less. Now what is most important that how much we are keeping our expenses for our needs? As much we keep low our expenses for needs as much will left with money to enjoy the life. So during our financial freedom time our liabilities should be very much low. To keep this low we need to complete all our liabilities before target age of financial freedom.

So what are those major liabilities need to be completed before completion of target age of financial freedom.

Own House

We need to ensure that the desire house can be purchased before reaching financial freedom goal. Our own house should able to fulfil all our future needs so further up gradation of the house can be avoided which many again create loan burden on us.

All the home loan liabilities should be cleared-off well in time so during our financial freedom time we should not have any home loan liability.

Interior of house

All required interior works/ needs should be completed like furniture, flooring, cabinets, kitchen equipment’s, home appliances etc. before reaching financial freedom goal. Our purchased house should have all such required things so further major expenditure can be completely avoided. Also all goods loan liabilities should be cleared-off well in time so during our financial freedom time we should not have any such loan liability.

Kid’s Liabilities

Kids’ education and marriage are the major liabilities which mostly taken care by parents. Our major expenditure are going in kid’s education. If they get right education & right employment in time then this expenditure will give fruitful result as now further they will take care of their liabilities and we can enjoy our money to lead free life.

Same way marriage is also very important one time liability on us. Minimum legal age of marriage in India is 21 years for males and 18 years for females. Although most of the Indian marriages are happening between age 21-26. If we consider age 26 of marriage then the kids liabilities will be get over before our age 50 or just above. If our child get job or regular earning source then only left with marriage liability for which we need lump-sum amount. So we need to keep lump-sum amount towards marriage of our kids.

Once we finish with these both liabilities of kids then our regular expenditures will be very less and we can use more money to enjoy the life.

Loan liability if any

We also need to ensure that all the loan liabilities should be cleared off before reaching financial freedom goal. Our financial freedom time should be debt free so we can enjoy time and money peacefully.

What should be the amount ?

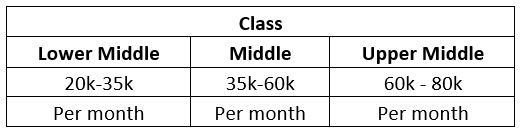

It’s difficult to quantify the money to enjoy the life but if we keep our lifestyle simple then living happy life will be much easy. Just to understanding the tentative money required per month to enjoy the life……

These amounts will vary person to person based on their dreams and way to enjoy the life.

If we can able to complete all major liabilities well before financial freedom goal then our expenditure towards monthly needs will be very less and we can use more money to enjoy the life. We need to focus on quality life rather than luxury life.

Well explained sir.

Good explanation sir ???? for saving money.