On financial liabilities front, we all want to live smooth stress free life. Having good job or business, living in beautiful house, buying stuffs for our needs, doing shopping, having food at restaurants, watching movies, spending on entertainment, traveling places, taking care of needs of spouse & Kids, paying EMIs for loans, paying insurance premiums etc. and many more things we are doing in our regular life.

These all things are going well as we have regular income either by job or business. But just think if suddenly this regular income stops then what you do ??

This is big question everyone should honestly ask to self as we are living in country where even after paying hefty taxes we don’t have any social security and in any such condition who will help.

- Any government scheme will take care of you ?

- Any organization will going to help you ?

- Any relative is going to help you ?

- Any friend going to help you ?

If you honestly ask these questions, you will find answer “NO”

Then who will help you?

In our country we do not have any government scheme which will take care of at least these basic needs like housing, food, medical when you don’t have anything. In many developed country people are covered with many such schemes as they are paying the taxes or taken schemes which run by government and against which their government is providing such facilities which take cares of their social security. But in our country no one will help when you don’t have anything so in short we do not have social security in our country.

So you are the only person who can help yourself if you are in such trouble in your life in any point of time. You have to create your social security by self only. You need to save money by your regular earnings and need to invest for social security.

We should not ignore this aspect and need to check your social security status.

So what should be checked ?

We need to check till how long we will sustain with money/ resources available with us. Also we need to check what minimum amount we need to run our basic need which is very essential to take care of our basic monthly expenses. After arriving the basic monthly expenses we can check the status of our security.

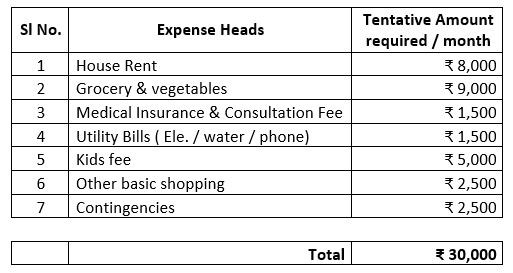

Minimum how much amount you need to sustain your life

First we have to find how much amount we need to run our family. This will differ person to person based on his /her requirements. Few are the major head like house, food, medical….etc. for which we need minimum money just to run the basic monthly needs. After finding the amount for basic monthly expenses you can check status of your social security level as per below chart.

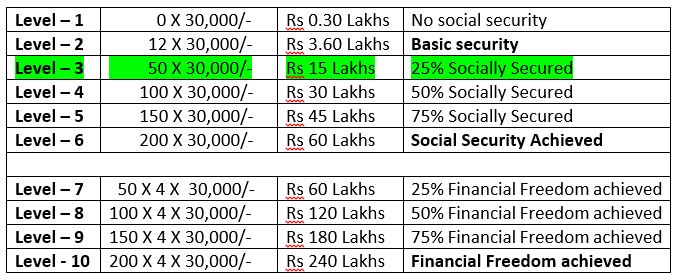

Check your Social Security level

After getting the basic monthly expenses you can multiply the basic monthly amount to with the given numbers and check your levels. Then you can check how much money is available with you and based on which you can check your current LEVEL of social security.

To understand better take example of the person who’s basic monthly expenses is Rs 30,000/- per month which includes all necessary expenses related to house rent, grocery & kitchen expenses, utility bills, kids education, clothing and other basic needs.

He/she is having savings of Rs 15 lakhs. Now as per chart the status of social security level of this person is Level – 3 as available saved available amount is Rs 15 Lakhs. See in table below

Here the person is not fully social secured, he has achieved only 25% social security level. This will keep him sustain for limited period. Once this person will reach to Level- 6 he will achieve the full social security. This means if at any point time in his/her life he suddenly stop earning he can easily sustain by money available with him and also the saved amount will be backing of his future needs.

By this social security chart you can also check the level of your financial freedom status. By achieving social security you can reach to Level -7 which is equal to achieving 25% target of Financial Freedom.

So how to create the Security Corpus ?

Creation of social security corpus is that easy?

Yes if you have discipline in savings and investments then you can able to achieve this. If we take above said example where the basic monthly expenses is Rs 30k and required corpus for social security is Rs 60 Lakhs. This 60 Lakhs look very big amount if someone want to save but it can become so easy if investment is systematic investment. If you save Rs 17k per month, you can able to create Rs 60 Lakhs in 15 years where your deposited amount is around Rs 30 Lakhs and interest on your deposited amount will be around Rs 30 Lakhs considering 8% returns on your investment.

After achieving social security if still you don’t need corpus to utilise it will give you interest earning of Rs 45,000/- per month which will be you another salary source.

To safeguard our future if we take pain and save some amount towards social security, this will help us in our bad time. After achieving the social security level if you don’t use this saved money it will give to regular monthly income which will be your extra income.

To give your valuable feedback or need any query related to the subject you are feel free to Contact Us.

Yes we should do.